Beneficiary ira calculator

As a beneficiary you may be required by the IRS to take annual withdrawals or required minimum distributions RMDs. 401 k Save the Max Calculator Determine if you are on track to save the max in your 401 k by maximizing your contributions each pay period so you can reach the allowed IRS limits.

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum.

. Compare 2022s Best Gold Investment from Top Providers. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be required to withdraw this year from the inherited account. The IRA owner names hisher spouse as sole primary beneficiary of the IRA.

If you were born on or after 711949 your first RMD will be for the year you turn 72. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Beneficiary Date of Birth mmddyyyy.

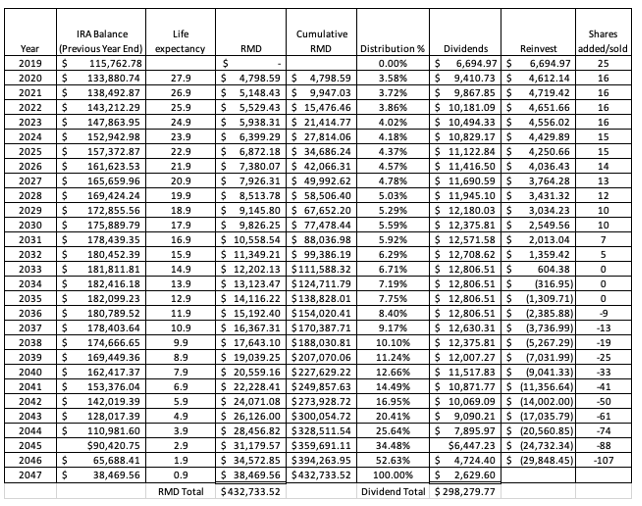

RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Beneficiary IRA Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA. Reviews Trusted by Over 45000000.

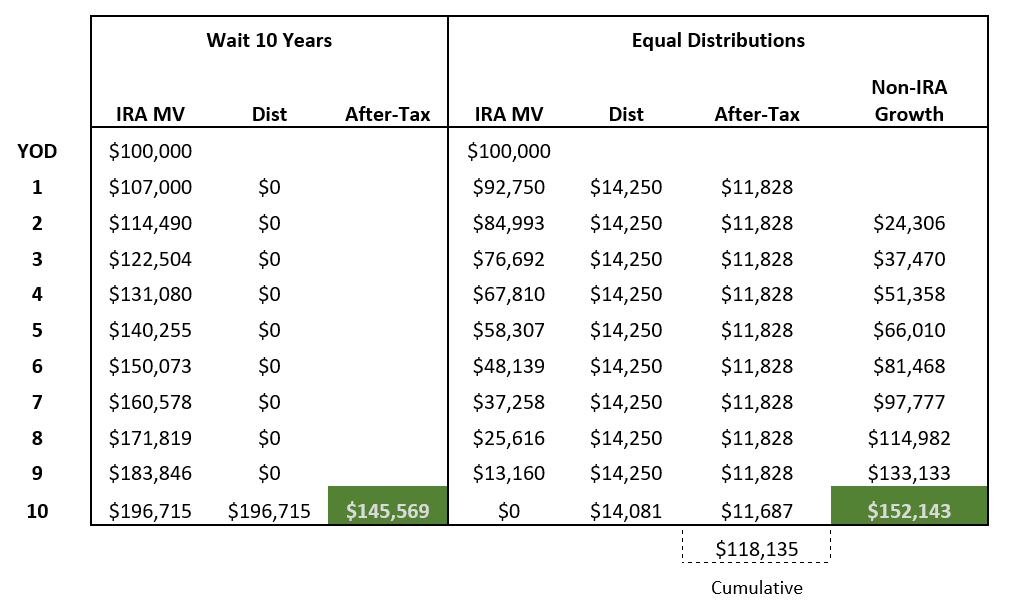

Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from HF Trade. How is my RMD calculated. For comparison purposes Roth IRA and regular taxable savings will be converted to after-tax values.

We offer bulk pricing on orders over 10 calculators. Get your own custom-built calculator. Beneficiary IRA distributions must generally begin in the year following the year of the IRA owners death.

401 k and IRA Required Minimum Distribution Calculator Determine your Required Minimum Distribution RMD from a traditional 401 k or IRA. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account.

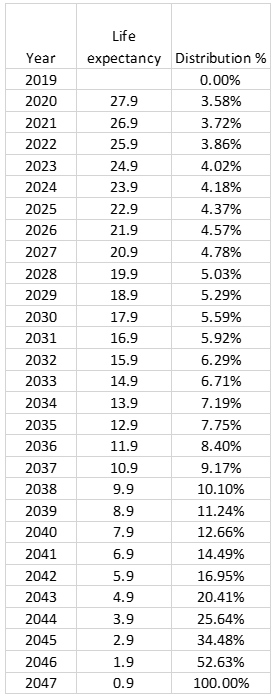

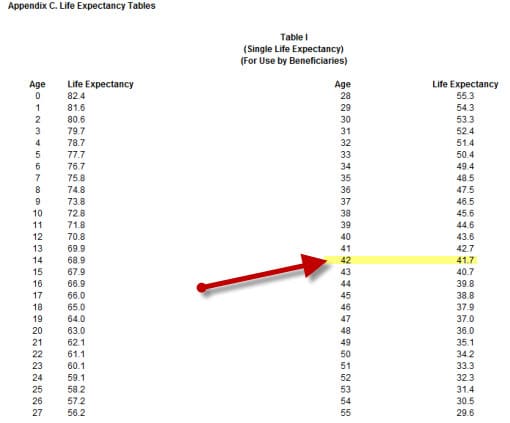

Paying taxes on early distributions from your IRA could be costly to your retirement. Use oldest age of multiple beneficiaries. Reduce beginning life expectancy by 1 for each subsequent year.

RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value. Can take owners RMD for year of death. Yes Spouses date of birth Your Required Minimum Distribution this year is 0 How is my RMD calculated.

Use this calculator to provide a hypothetical projection of the required minimum distributions for you and your beneficiary. This calculator has been updated for the SECURE Act of 2019 and CARES Act of 2020. This is used for calculating life expectancy.

Calculate the required minimum distribution from an inherited IRA. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age.

A Retirement Calculator To Help You Discover What They Are. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. You can also explore your IRA beneficiary withdrawal options based on your circumstances.

To determine what your withdrawal options might be select the Identify Beneficiary Options button below. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement.

This is only used to help project your future account balances which of course will impact your required minimum distribution. This tool will help you estimate the annual withdrawals you may need to take. Account balance as of December 31 2021 7000000 Life expectancy factor.

Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. Beneficiary RMD Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. Determine beneficiarys age at year-end following year of owners death.

Ad A Retirement Calculator To Help You Plan For The Future. Hypothetical Interest rate This is the expected rate of return on your account. Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary.

Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. While alive the IRA owner begins taking RMD payments at age 72 or 70½ if born before 711949 using a factor from the IRS Uniform Lifetime Table to calculate the distribution unless the spouse is more than 10 years younger than the owner and is the owners sole.

To calculate Roth IRA with after-tax inputs please use our Roth IRA Calculator. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much you may be required to withdraw this year from the inherited account. Distribute using Table I. Beneficiarys birthdate Enter the beneficiarys birth date.

But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply. The SECURE Act of 2019 changed the age that RMDs must begin.

You Ve Inherited An Ira What Happens Next Cd Wealth Management

The Inherited Ira Portfolio Seeking Alpha

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Calculator

Required Minimum Ira Distributions Tax Pro Plus

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Ira Withdrawal Calculator Deals 57 Off Www Alforja Cat

The Inherited Ira Portfolio Seeking Alpha

Top 5 Best Ira Calculators 2017 Ranking Calculate Tax Rmd Withdrawal Distribution Sep Beneficiary Advisoryhq

Ira Withdrawal Calculator Hotsell 59 Off Www Ingeniovirtual Com

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

Inherited Ira Rmds Required Minimum Distributions

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Required Minimum Distributions Rules Heintzelman Accounting Services

Rmd Tables